CalSTRS Calculator – Estimate Your Retirement Benefit with Confidence

Planning for retirement can feel overwhelming. You’re thinking ahead: “How much will I receive? When should I retire? Will I have enough?” If you’re a member of the California State Teachers’ Retirement System (CalSTRS), here’s the good news you don’t have to rely on guesswork. Our CalSTRS Calculator on AllUtilityTools.com helps you estimate your future retirement benefit with ease and clarity. Whether you’re early-career or nearing retirement, knowing the numbers helps you make better decisions. Let’s walk through what this calculator is, why it matters, how it works, and how you can use it quickly.

What is CalSTRS Calculator?

A “CalSTRS Calculator” is an online tool designed to estimate the retirement benefit you might receive from CalSTRS. It uses inputs like your service credit, age at retirement, and final compensation (highest salary years) to predict what your monthly retirement payment might look like.

For example, on the official CalSTRS site you’ll find a calculator that says: “This calculator is provided as a retirement planning tool to help you estimate your future retirement benefit.”

In other words, it’s not a guarantee, but a helpful estimate. On AllUtilityTools.com, our version simplifies that process and delivers an easy-to-use interface for users everywhere.

Why Use It

✓ Get clarity on your future

When you plug in your data, you’ll see a numerical estimate of your monthly benefit giving you a clearer picture of your retirement income. CalSTRS itself indicates that your benefit replaces, on average, about 54% of your current salary.

✓ Plan ahead and make better choices

Knowing your projected benefit lets you ask smart questions like: Should I work another year? Should I increase my salary before retiring? Could I supplement with other savings?

✓ Avoid surprises

Without a calculator, you might assume a higher or lower number than what you really get. Using a tool helps you avoid big surprises at retirement time.

✓ Save time and reduce complexity

Instead of reading through dense benefit handbooks or hiring a consultant, you can get a quick estimate yourself. That empowers you and it keeps things simple.

4️⃣ How It Works

Here’s a breakdown of how a CalSTRS Calculator typically arrives at an estimate, and how our version on AllUtilityTools.com mimics that process with a friendly interface.

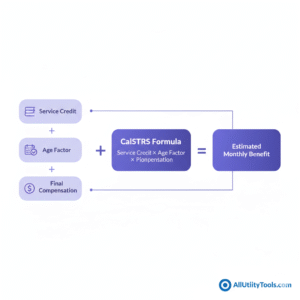

Key inputs

- Service Credit: The number of years (including partial years) you’ve worked and made contributions.

- Age Factor: This is a percentage that varies depending on your age when you retire and your benefit structure (for example “2% at 60” or “2% at 62”).

- Final Compensation: Usually the average of your highest consecutive earnings years (for example, highest 36 or 12 months) depending on your membership status.

Core formula

Many calculators (including CalSTRS’s own) use a simplified version of this formula:

Service Credit × Age Factor × Final Compensation = Monthly Retirement Benefit

Our AllUtilityTools CalSTRS Calculator takes your inputs and uses this formula (with user-friendly tweaks) to generate your result.

Additional considerations

- Some calculators allow factoring in beneficiary options (which may reduce your monthly benefit).

- The estimate is non-binding and depends on future changes in salary, service credit, legislation, etc. CalSTRS emphasises this.

What our tool does differently

- Clean, minimal interface: you don’t need to dig through menus.

- Pre-set standard age factors and benefit structures so you don’t need to hunt for those tables.

- A results page that shows your estimated monthly benefit, a replacement-percentage estimate (how much of your salary it might represent), and simple next-steps (e.g., “Work 1 more year? See impact”).

How to Use It on AllUtilityTools.com

Here’s a friendly step-by-step guide to using our CalSTRS Calculator on AllUtilityTools.com:

- On your browser, go to AllUtilityTools.com and navigate to the “CalSTRS Calculator” tool.

- Choose your unit system (if relevant, e.g., annual salary in dollars).

- Enter your service credit: input how many years (and months) of teaching/service you expect to have at retirement.

- Select your benefit structure: For example “2% at 60” or “2% at 62” (we have a dropdown for typical CalSTRS benefit types).

- Enter your final compensation: This is your highest average salary period (we show guidance like “enter your average of highest 36 months”).

- (Optional) If your career includes beneficiary option or other special conditions, tick the “advanced options” box and enter.

- Click “Calculate”.

- Review your Estimated Monthly Benefit, plus supporting numbers (such as what percent of your final salary it represents), and a little summary like “If you retire at age X with Y years of credit, here’s your estimate.”

- Use the “Compare” feature if available: “What if you worked one more year?” or “What if your final compensation increases by 5%?”

- Print or save your result (there’s a “Download PDF” button). You can bookmark the page and re-run the estimate later as things change.

6️⃣ Real-Life Example

Let’s walk through a practical scenario to see how our tool helps all done with approximate numbers for illustration:

Scenario

Teacher Jane is 57 years old. She expects to retire at age 60. She has 30 years of service credit, and her highest earnings average over the last 3 years was $90,000/year. Her benefit structure is “2% at 60”.

Using our tool

- Enter Service Credit → 30 years

- Select Benefit Structure → 2% at 60

- Enter Final Compensation → $90,000

- Click Calculate

- Result: Estimated Monthly Benefit = $4,500 (which is roughly 60% of her final salary)

- The tool also shows: If she worked one more year (31 years), benefit rises to maybe $4,650 (approx +3.3%).

What this tells Jane

- With a monthly benefit of $4,500, she can estimate annual retirement income of $54,000 (before taxes).

- She can compare that to her annual expenses today.

- She can consider whether it’s worth working an extra year (31 vs 30) to boost lifetime benefit.

- She can adjust other savings (IRA, 403(b), etc.) accordingly.

This clear scenario demonstrates how our CalSTRS Calculator on AllUtilityTools.com converts abstract inputs (years, salary) into actionable numbers for your planning.

Tips / Common Mistakes

Tips for best accuracy:

- Double-check your “highest earnings” period. Many times people enter their current salary rather than the required average of highest 12 or 36 months.

- Be realistic about your service credit sometimes leaves of absence or part-time service reduce years.

- Use the “Compare” feature: seeing how an extra year or higher salary affects your benefit can be motivating.

- Save your estimate and revisit it annually as salary or service credit changes, so will your number.

- Use this estimate along with other retirement tools (e.g., Social Security, other savings) so you get the full picture.

🚫 Common mistakes to avoid:

- Ignoring the benefit structure (2% at 60 vs 2% at 62) using the wrong structure skews results.

- Forgetting to subtract any future breaks or part-time years if you assume full years but had part-time service, your service credit might be lower.

- Assuming the result is guaranteed remember: these are estimates only; actual benefit may differ.

- Relying solely on one tool retirement planning is multi-dimensional (health care, inflation, other savings).

- Not reassessing your estimate life changes (salary raises, additional service) matter.

FAQs

Q1: What does “benefit structure” mean in CalSTRS terms?

A: Benefit structure refers to the formula under which you’re retired for example, “2% at 60” means you accrue a factor that provides about 2% of your final compensation per year of service at age 60.

Q2: Is the estimate from the calculator guaranteed?

A: No. CalSTRS clearly states that estimates are non-binding and for planning only.

Q3: Can I use this calculator if I’m part-time or have non-traditional service years?

A: Yes — but you’ll want to adjust your service credit accordingly (part-time years count proportionally) and ensure your highest earnings period is accurate.

Q4: What happens if my salary increases just before retirement?

A: That can boost your “final compensation” number, which in turn raises your estimated benefit. It’s worth updating the calculator when salary changes.

Q5: How often should I use the calculator?

A: Ideally every year or whenever you have a significant change (more service credit, salary jump, new employment etc.).

Q6: Can I include other savings (403(b), IRAs) in this calculator?

A: No — the CalSTRS Calculator focuses only on your CalSTRS pension benefit. Use it alongside other savings calculators for the full retirement picture.

Conclusion & Call to Action

Planning for retirement doesn’t have to be a confusing maze. With our CalSTRS Calculator on AllUtilityTools.com you get fast, friendly, accurate estimates that help you make smarter decisions today for what happens tomorrow. Enter your service years, salary, benefit structure get your estimated monthly benefit and move forward with confidence.

Try our free CalSTRS Calculator now and take one more step toward a secure, predictable retirement. Bookmark your result, revisit as things change, and use it as a foundation for your broader retirement strategy. Your future self will thank you.