When you have more than one loan, credit card debt or outstanding debt with varying interest rates, it gets confusing trying to figure out what you actually pay. You might ask: “If I combine these, what is my true interest rate?” That’s precisely what a Blended Rate Calculator helps with — it gives you a single, clear interest‐rate number that reflects all your debts together.

On AllUtilityTools.com, our calculator makes this process quick, intuitive and accurate. No more guessing. No more scrambling through spreadsheets. Just a simple tool to help you make smarter borrowing or refinancing decisions. Let’s explore what this tool does, why it’s useful, how it works, and how you can use it effectively.

What is a Blended Rate Calculator

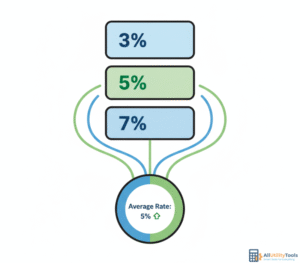

A blended rate refers to the weighted average interest rate of two or more loans, debts or amortizations combined into one total balance. Omni Calculator+2Barrett Financial+2

Put simply: You owe amounts at different rates; a blended rate shows the average cost of borrowing across all those amounts.

Here’s how to think about it:

- If you have Loan A at 5 % interest and Loan B at 10 % interest, you would like to know: What’s the effective interest rate I’m paying on the combined debt?

- The blended rate calculator takes each amount + its rate, computes a weighted average, and gives you a single rate. Omni Calculator+1

This tool is especially useful when you are considering consolidating, refinancing or simply reviewing your overall debt load.

Why Use It

Using a blended rate calculator offers several key benefits:

Gain clarity

With multiple loans at varying interest rates, it’s difficult to keep track. This calculator provides you with one neat number your actual average rate of interest.

Compare options efficiently

When you’re thinking about refinancing or consolidating, you’ll want to compare your current blended rate with what a new loan offer might give you. If your blended rate is higher than a new loan’s rate, refinancing might make sense.

Better decision-making

If you know your blended rate, you can determine whether to pay off a particular loan, consolidate, or maintain status quo. You can simply ask: Is the new deal really improved compared to my current average?

Budgeting and forecasting

Once you know your total interest-cost, you can budget more effectively. You won’t be caught off guard with larger interest burdens because you got derailed by individual numbers.

Save time and avoid error

It saves time. Multiple interest rates and balances are calculated manually, which is error-prone. The calculator does it automatically and minimizes errors.

In brief: It’s about taking multiple confusing figures and distilling them into one useful number one that represents your blended interest rate—and using it to make smarter money moves.

How It Works

Knowing how it works gives more assurance of using the tool. Here’s the explanation:

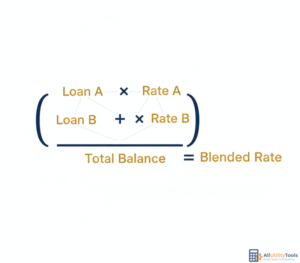

The formula

A popular formula employed is:

Blended Rate = (Sum of (Balance × Rate) for every loan) ÷ (Sum of all balances)

Omni Calculator+1

For example:

- Loan A: $100,000 @ 2.5 %

- Loan B: $20,000 @ 4.0 %

- Combined total balance = $120,000

- Combined interest = $100,000×2.5 % + $20,000×4.0 % = $2,500 + $800 = $3,300

- Blended Rate = $3,300 ÷ $120,000 = 0.0275 or 2.75 %

Omni Calculator

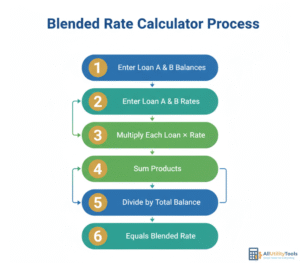

🧮 Step-by-step

- Enter each individual loan / debt amount (balance)

- Enter the interest rate for each amount

- The calculator multiplies each balance by its rate to get a “weighted interest”

- It sums all those weighted interest values

- It divides that sum by the total balance of all debts

- You get the blended rate a single percentage figure

🎯 Why accuracy matters

- All balances should be measured at the same point in time (you don’t mix old and new numbers incorrectly)

- Interest rates should reflect the same period (annual, monthly) for consistency

- If you add or remove a loan later, you should recompute the blended rate

The underlying math is simple, but the value lies in applying it correctly and that’s what our calculator at AllUtilityTools.com helps you do quickly and reliably.

How to Use It on AllUtilityTools.com

Here’s how you can use our Blended Rate Calculator on AllUtilityTools.com, step by step:

- Visit AllUtilityTools.com and select the Blended Rate Calculator tool from the menu

- Choose your input units if applicable (for interest rate period: annual, monthly)

- For each debt or loan you hold:

- Enter the current outstanding balance

- Enter the interest rate associated with that balance

- If you have more than two loans, add additional rows as needed

- Review the total balance computed automatically by the tool

- Click “Calculate” (or a similar button)

- The tool displays your Blended Rate (in %), and may show a breakdown (optional)

- Use the result to compare with new financing offers, evaluate consolidation decisions or simply monitor your debt profile

- For better decision making, you might also enter a proposed new loan to see how it affects your blended rate

Tip: After you get your blended rate, enter it into your budgeting or refinancing evaluation to see whether the average interest you’re currently paying is acceptable or could be improved.

Real-Life Example

Let’s walk through a realistic example to show how this works:

Scenario:

You have three outstanding loans:

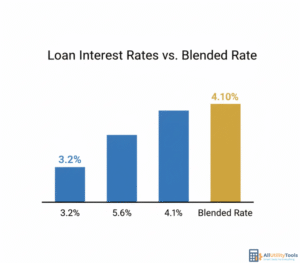

- Loan 1: $50,000 @ 3.2 %

- Loan 2: $30,000 @ 5.6 %

- Loan 3: $20,000 @ 4.1 %

Total balance = $100,000

Weighted interest calculation:

- Loan 1 interest = $50,000 × 3.2% = $1,600

- Loan 2 interest = $30,000 × 5.6% = $1,680

- Loan 3 interest = $20,000 × 4.1% = $820

Sum of weighted interest = $1,600 + $1,680 + $820 = $4,100

Blended Rate = $4,100 ÷ $100,000 = 4.10%

Interpretation:

Although the individual loans’ rates ranged from 3.2 % to 5.6 %, the aggregated effective rate you’re paying across all of them is 4.10%.

With that number, you can ask: Is there a refinancing offer around or below 4.10 % that makes sense after fees? If yes, you might save money. If the new offer is higher, maybe you hold off.

Why this matters:

Imagine you got a new loan offer at 3.9 %. That’s slightly below your blended rate of 4.10 % perhaps worth exploring. On the other hand, if the offer is 4.5 %, you’re actually worse off than your current blended position.

This example shows how the calculator gives you big-picture clarity that raw individual rates might obscure.

Tips / Common Mistakes

Here are some practical tips and common mistakes to avoid when using a blended rate calculator:

👍 Smart Tips

- Double-check your balances: Use the most recent statement for each loan to ensure accuracy.

- Align interest rate periods: Make sure all rates you input are annual or use consistent periods.

- Include all debts: If you forgot one smaller loan, your blended rate will be off.

- Use the result for comparison: Once you have your blended rate, compare with new offers—fees included.

- Re-run the calculation after any significant change: When you pay off one loan or add a new one, update your numbers.

❌ Common Mistakes

- Mixing old balances with current: Using outdated balances will distort your results.

- Inputting interest rates with inconsistent periods: e.g., monthly rate vs annual rate without conversion.

- Ignoring small debts: Even small loans can shift your blended rate when aggregated.

- Assuming the blended rate is final: Use it as a tool for decision making, not a guarantee.

- Overlooking fees: A lower interest rate doesn’t always mean lower total cost if fees are high.

By keeping these tips in mind, you’ll get far more accurate and actionable results from your calculator.

FAQs

Q1: What is a “blended rate”?

A: A blended rate is the effective weighted average interest rate across multiple loans or debts, combining different balances and interest rates into one percentage. Omni Calculator

Q2: Can I use the calculator for credit cards, auto loans and personal loans together?

A: Yes — as long as you enter each outstanding balance and its monthly or annual interest rate consistently, the calculator will compute your overall blended rate.

Q3: Does the blended rate calculator replace a full refinancing analysis?

A: No. It gives you clarity about your current rate but doesn’t include all factors (e.g., loan term changes, fees, pre-payment penalties). Use it as a first step.

Q4: How often should I recalculate my blended rate?

A: It’s a good idea after any significant change: payoff of a loan, addition of a new loan, or when you receive a refinancing offer.

Q5: Will a lower blended rate always mean lower monthly payments?

A: Not necessarily. The blended rate tells you average interest, but monthly payments depend on term length, amortisation schedule, fees and other variables.

Q6: Can this tool help me decide whether to consolidate my loans?

A: Yes by comparing your current blended rate with a proposed consolidation loan’s rate (plus fees), you can make an informed decision.

Conclusion with CTA

When you have more than one loan or debt balances, the figures can get jumbled. Your own individual interest rates may look good but you may not realize the whole picture. Applying a Blended Rate Calculator on AllUtilityTools.com assists you in consolidating those figures and realizing your actual average cost of borrowing.

Take a few minutes now: Go to AllUtilityTools.com, choose the Blended Rate Calculator, enter your balances and rates, and find out what rate you’re actually paying. With that knowledge, you can shop with confidence, budget more precisely, and make better financial choices.