Imagine you’ve just secured a new tractor, or you’re acquiring additional acreage to expand your crop rotation. You know the loan amount, you think you know the interest rate but what will your payments really look like over the coming years? A small miscalculation now can turn into big surprises later.

With the farm credit loan calculator you get a realistic estimate of monthly or annual payments, factoring in interest, term length and payment frequency. It puts you in the driver’s seat, so you can budget properly, avoid cash-flow shocks and steer your operation toward stability.

In this article, we’ll unpack everything you need to know about how the calculator works, and how you can use the version on AllUtilityTools.com to your advantage.

2️⃣ What is a Farm Credit Loan Calculator?

A farm credit loan calculator is an online tool designed to estimate payments on loans made to farm operations including equipment loans, land purchase loans, operating lines of credit or other agricultural-purpose borrowings. These calculators are tailored to the agricultural financing sector (though the underlying math is similar to other types of loans).

Specifically, they allow you to input variables like:

- Loan amount

- Interest rate (annual percentage)

- Term of the loan (in years or months)

- Payment frequency (monthly, quarterly, semi-annual, annual)

- Optional extra fees or balloon payments (in some advanced tools)

Once you input these, the calculator will compute an estimated payment schedule: how much you’ll pay each period, what portion goes to principal vs. interest, and sometimes the total interest paid over the life of the loan.

Many agricultural lenders, such as those in the Farm Credit Services of America network, offer their own calculators for farm or land loans.

What makes the “farm credit” version distinct is its alignment toward agriculture: loan terms suited for farm cycles, payment frequencies that match harvest or livestock schedules, and often borrower-friendly amortization structures.

3️⃣ Why Use It

✅ Budget with confidence

When you have a clear payment estimate, you can plan your crop budgets, equipment replacement schedules or land acquisition without guessing.

✅ Compare loan offers

If you’re negotiating with lenders, you might get different interest rates or term lengths. A tool lets you plug each scenario in side-by-side and pick the best.

✅ Avoid surprises

Without estimating, you might assume “I’ll just handle the payments,” only to discover that the actual payment is higher than your cash flow allows. The calculator helps avoid those pitfalls.

✅ Align payments with farm realities

In agriculture, cash flow isn’t always monthly and uniform: you may have seasonal income, harvest lulls, livestock fluctuations. A calculator that allows quarterly or semi-annual payments (which many farm-lenders’ calculators allow) is particularly suited for farms.

✅ Strengthen your application

When you show a lender or investor that you’ve modelled different payment scenarios, you come across as more prepared, reducing risk in their eyes.

4️⃣ How It Works

Let’s dive into the mechanics behind the calculator without making things too complicated.

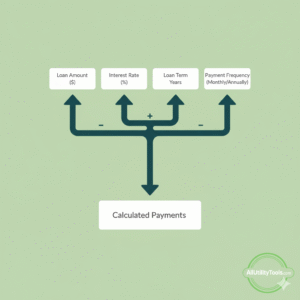

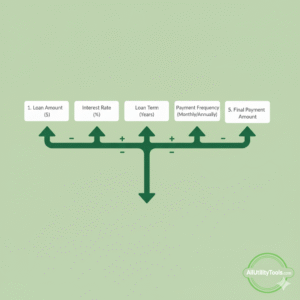

- Input the basic variables

- Loan Amount (L): The total amount you plan to borrow.

- Interest Rate (r): The annual interest rate (for example, 5%).

- Term (T): The length of the loan, often in years (for example, 10 years).

- Payment Frequency (f): How often you pay (monthly = 12, quarterly = 4, semi-annual = 2, annual = 1).

- Compute the periodic interest rate

If your interest rate is annual (r) and you pay monthly (f = 12), then periodic rate i = r / f.

- Number of payments

Total number of payments .

- Use the amortization formula (for fixed payment loans)

A common formula for fixed payments is:

Where:

- L = loan amount

- i = periodic interest rate

- n = total number of payments

If your payment frequency is quarterly or semi-annual, you adjust f and i accordingly.

- Additional features

The calculator may also show:

- Total interest paid over the life of the loan

- Principal vs interest breakdown by period

- Payment schedule (sometimes)

- How payment changes if you change the interest rate or term

Agricultural calculators often let you toggle payment frequency to match farm income patterns (e.g., paying quarterly after harvest). For example, one lender’s tool explicitly supports monthly, quarterly, semi-annual or annual schedules.

- Interpreting the output

Once you get the payment figure, you use that to assess:

- Is it affordable given your farm income and cash flow?

- Would a shorter term and slightly higher payment save interest cost?

- What happens if the interest rate increases by 1% down the line?

- Would paying quarterly instead of monthly give you more flexibility?

By adjusting inputs you can explore “what-if” scenarios key to good farm finance planning.

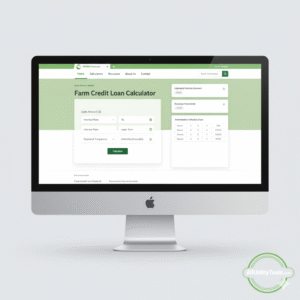

5️⃣ How to Use the Farm Credit Loan Calculator on AllUtilityTools.com

Here’s a friendly step-by-step guide for visitors of AllUtilityTools.com to use our calculator:

- Visit AllUtilityTools.com and navigate to the Farm Credit Loan Calculator tool.

- Choose your units (if applicable) some regions prefer monthly payments, others quarterly or annual.

- Enter the loan amount you’re considering. For example: $150,000.

- Input the interest rate (annual percentage rate). Example: 6%.

- Select the term length (in years). Example: 10 years.

- Choose your payment frequency: monthly, quarterly, semi-annual or annual.

- (Optional) If our tool supports it, enter any balloon payment or extra fees at term end.

- Click the “Calculate” button.

- Review the results: your payment per period, total payments over life, total interest.

- Use the results to compare with your budget, cash flow, and alternate scenarios.

Pro tip: After getting the result, save or print the estimated schedule so you can reference it with your lender or track your farm’s budget.

With our calculator, you don’t need spreadsheets or manual amortization worksheets—you get fast, accurate estimates in seconds.

6️⃣ Real-Life Example

Let’s walk through a realistic scenario to see the calculator in action.

Scenario

You run a mid-sized grain farm. You’re buying a combine and associated header for $200,000. You negotiate a loan at an annual interest rate of 5.5%, with a 7-year term, and you plan to make annual payments (since most of your cash flow comes after harvest once a year).

Input into calculator

- Loan amount: $200,000

- Interest rate: 5.5%

- Term length: 7 years

- Payment frequency: annual (f = 1)

Calculation (roughly)

Periodic interest rate i = 5.5% / 1 = 5.5% (or 0.055)

Number of payments n = 7 × 1 = 7

Using the formula:

Over 7 years, you’d pay approximately 7 × $33,865 = $237,055. So the total interest you’ll pay is close to $37,055.

What it tells you

- Annual payment of about $33,865 does your farm expect that level of surplus in the post-harvest period?

- If you reduce the term to 5 years (keeping the same rate), the payment might jump to ~$46,000 per year, but you save significant interest.

- If you instead pay semi-annually or monthly, your cash flow might improve, but interest cost may change slightly depending on how the lender structures it.

How you use the insight

With the calculator result in hand you might conclude:

- “Yes we have that surplus capacity, so the 7-year annual payment is viable.”

- Or: “No perhaps we should extend to 10 years or shift to quarterly payments to ease cash flow.”

- Or: “Maybe negotiate the rate down, or make a larger down-payment and borrow less.”

The key: the calculator gives concrete numbers, not guesswork.

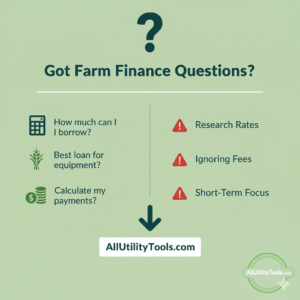

7️⃣ Tips for Best Results / Common Mistakes

✅ Tips

- Enter realistic interest rates. Don’t assume an ultra-low rate use what your lender is offering or a conservative estimate.

- Try different payment frequencies to match your farm’s cash flow. Annual payments may suit harvest-heavy income, but monthly might suit livestock operations.

- Use the results to compare scenarios: shorter term vs longer term, higher rate vs lower rate, different frequencies.

- Save the results. Show them to your lender or keep as a budget tool.

- Couple the calculator with your broader budget (equipment operating cost, repairs, labor, crop input). Don’t consider the loan in isolation.

❌ Common Mistakes

- Forgetting that payment frequency affects cash flow. A monthly payment may be smaller, but if your farm income comes annually, you might struggle to make 12 smaller payments rather than a single annual lump sum.

- Ignoring total interest cost. A longer term loan might reduce payments, but you’ll pay a lot more in interest over time.

- Using unrealistic or overly optimistic inputs. Example: assuming a 3% rate when you actually expect 6%. That skews your budget.

- Not accounting for variable rates. If your loan isn’t fixed-rate, interest might rise and payments could increase so build a buffer.

- Neglecting other farm financing obligations. Your new loan payment is just one piece of the puzzle; you still have crop input loans, equipment maintenance, and operational costs.

8️⃣ FAQs

Q1: What types of loans can the farm credit loan calculator handle?

A: You can use it for equipment loans, land purchase loans, operating lines of credit all types where you borrow a sum and repay with interest over time, provided you enter the correct variables.

Q2: Does payment frequency matter?

A: Yes—it affects how much you pay each period and how that aligns with your income. Many farm calculators support monthly, quarterly, semi-annual or annual payments.

Q3: Can I change the interest rate or term to compare scenarios?

A: Absolutely. One of the advantages of the calculator is the ability to test “what-if” scenarios—what if rate is 6% instead of 5.5%, or what if the term is 10 years instead of 7.

Q4: Will the tool tell me about fees, down-payments or tax implications?

A: Generally no. The calculator focuses on payment estimation based on loan amount, rate and term. Fees, down-payments, tax effects and insurance must be considered separately.

Q5: Is the estimate guaranteed?

A: No. The result is an estimate based on your inputs. The actual loan terms you receive from a lender will depend on credit, collateral, variable rate changes and other factors so use the estimate as a planning tool, not a guarantee.

Q6: Should I use this tool before talking to a lender?

A: Definitely. Knowing your payment estimate ahead of time makes you a more informed borrower and improves your negotiation position.

9️⃣ Conclusion & Call to Action

Head to AllUtilityTools.com, open the Farm Credit Loan Calculator, input your numbers, and get a clear payment forecast in seconds. The earlier you model your financing, the stronger your budget, the smarter your decision—and the healthier your farm’s financial future.