Introduction

Struggling with high credit-card balances, juggling multiple monthly bills, or paying too much interest? You’re not alone. Using a balance transfer calculator can help you see how moving your debt to a lower-interest (or 0% intro rate) card could save you serious money. On AllUtilityTools.com we’ve built a simple, free tool that lets you plug in your numbers and instantly understand how much you might save, how long it could take to pay off, and what fees you need to factor in. In this article, we’ll explore what this tool does, why it matters, how it works, and how you can use it with confidence.

What Is a Balance Transfer Calculator?

A balance transfer calculator is an online tool that helps you estimate the impact of moving (or “transferring”) one credit-card balance (or possibly more than one) to another credit line with a lower interest rate or a promotional 0% interest period.

In essence, the calculator takes your current balance, your current annual percentage rate (APR), any promotional rate on a new card, the length of that promotion, and any transfer fees and then shows you how much interest you could save, how long it might take to pay off, and what the trade-offs are.

Here are key points about the concept:

- A balance transfer is when you move debt from one credit account to another (usually to save interest) Wikipedia

- The calculator automates the math, showing scenarios rather than you doing dozens of manual calculations.

- It’s a planning tool not a guarantee. Actual results depend on your payments, card terms, and timing.

By using such a calculator, you gain clarity on whether a balance transfer is worthwhile, or if you might be better staying put. On AllUtilityTools.com, our calculator is designed to be intuitive and beginner-friendly.

Why Use It

Why should you use a balance transfer calculator instead of just guessing or doing rough math? Here are some strong reasons:

Save Interest Costs

If you transfer a balance from a high-interest credit card to one with a 0% or much lower APR, you can significantly reduce how much interest you’ll pay. The calculator shows you that savings.

Plan Pay-off Strategy

It helps you figure out how long it will take to clear your debt if you pay a certain monthly amount under the new terms.

Compare Scenarios

What if you don’t transfer? What if you do but pay more or less each month? The calculator offers scenarios so you see the benefit (or lack thereof).

Avoid Surprises

Transfer fees (often 3-5% of transferred amount) and expiration of promotional rates must be factored in. The calculator includes those so you don’t get blindsided.

Increase Confidence

Instead of guessing “maybe I’ll save,” you can see the numbers clearly and make a more informed decision.

Improved Financial Understanding

Utilizing the calculator teaches you about interest, how promotional periods work and what to look out for when transferring.

In brief: this tool provides insight over hope, clarity over confusion.

How It Works

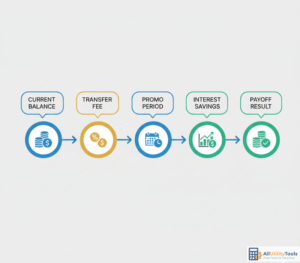

Let’s dissect the logic of the balance transfer calculator so you know the inputs, the calculations, and the output.

Key Inputs

- Current Balance: The amount of debt you plan to transfer.

- Current APR: The annual interest rate you’re paying now.

- New Card Promo Rate: The interest rate offered for the balance transfer (often 0% for X months).

- Promo Period Length: How many months the new low/0% rate lasts.

- Transfer Fee: A percentage of the amount transferred (for example 3% of the balance).

- Regular APR after Promo: What your rate will be once the promo ends.

- Monthly Payment: How much you plan to pay each month toward the balance.

Basic Formula & Logic

- Calculate interest you will pay now: Based on your current balance and APR, assuming no transfer.

- Calculate interest under transfer scenario:

- No interest during promo period (if 0% rate).

- Add transfer fee.

- After promo ends: apply the regular APR for remaining balance until paid off.

- Compare the two scenarios: Show total cost of staying versus transferring, and therefore the savings.

- Pay-off timeline: Given your monthly payment, estimate how many months it will take under the new scenario.

- Highlight trade-offs: Even if rate is low, high monthly payment or short promo might mean less savings.

What You’ll See as Output

- Estimated interest saved (or cost) by transferring.

- Estimated time to pay off the transferred balance given your monthly payment.

- Total cost in both scenarios (with and without transfer).

- The «break-even» point: when you actually start saving money after accounting for fees.

Why It Works

By isolating all the variables and comparing apples-to-apples, a calculator helps eliminate guesswork. You can see how a small fee today might still produce big savings over months or years.

How to Use It on AllUtilityTools.com

Using our balance transfer calculator is easy. Here’s how you do it step-by-step:

- Visit AllUtilityTools.com, then choose the “Balance Transfer Calculator” tool from the tools menu.

- Set your cost units: Make sure your currency and date formats match your region.

- Enter your Current Balance: Input the amount you owe and plan to transfer.

- Enter your Current APR: Input the annual interest rate on your current card(s).

- Enter the New Card Promotion Rate: Example 0% for 12 months.

- Enter the Promo Period Length: Specify how many months the promotional rate will last.

- Enter the Transfer Fee: For example, 3% of the transferred amount (or as your card issuer states).

- Enter the Regular APR After Promo: What interest you’ll pay once the promo ends.

- Enter Your Planned Monthly Payment: How much you will pay each month toward the debt.

- Click “Calculate”.

- Review results:

- Look at the interest you’ll save.

- Check how long it will take to pay it off under the new scenario.

- Compare with staying on your current card(s).

- Use the result to decide whether a balance transfer makes sense.

- Optional: Adjust any input (e.g., increase monthly payment, change promo period) and recalculate to see different outcomes.

Pro tip: Consider printing or saving the result so you have a reference when you talk to your card issuer or plan your repayment schedule.

Real-Life Example

Let’s work through a realistic example to show how the calculator delivers value.

Scenario:

You have $8,000 on a credit card with a 20% APR. You can qualify for a new card that offers 0% interest for 12 months, after which the rate will be 18%. The transfer fee is 4% of the balance. You plan to pay $300 per month.

Using the calculator:

- Current Balance = $8,000

- Current APR = 20%

- New Promo Rate = 0%

- Promo Period = 12 months

- Transfer Fee = 4% → $320 fee (4% of $8,000)

- Regular APR after promo = 18%

- Monthly Payment = $300

Results (approximate, for illustration):

- Without transfer: Paying $300/month at 20% APR might take ~36 months and cost ~$2,400 in interest (rough figure).

- With transfer: No interest for first 12 months, you pay $300×12 = $3,600 during that period, plus $320 fee = $3,920 total paid so far. After 12 months you still owe (approx) $8,000 − $3,600 = $4,400. Then you pay at 18% APR at $300/month: it might take ~17 more months and interest of perhaps $500–$600. Total cost: $3,600 + $320 + $500 = ~$4,420. That’s less than the $2,400 + principal you’d have paid without transfer? Actually in this case you saved ~$1000–$1500 in interest and paid faster. (Exact numbers depend on amortization.)

- Conclusion: The calculator shows you that doing the transfer could save a significant amount of money and shorten your debt period.

You’d use our tool, input these numbers, and instantly get the comparison which helps you decide whether to apply for the new card and transfer the balance.

Tips / Mistakes to Avoid

Here are some practical tips and common pitfalls to watch out for when using a balance transfer calculator or making a transfer decision:

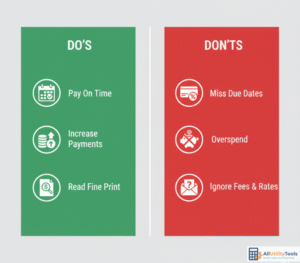

✅ Tips

- Pay more than the minimum monthly payment the faster you pay, the more you save.

- Enter accurate numbers (balance, APR, fees, payment) errors lead to misleading results.

- Ask about balance transfer fees sometimes they’re hidden or vary by card.

- Confirm the promo period length if it’s less than you expect, you may incur high interest.

- After transferring, stick to your payment plan and avoid adding new debt to the old card.

❌ Mistakes to Avoid

- Ignoring transfer fee: A 3–5% fee may offset savings if not considered.

- Assuming the 0% rate lasts forever: Many promos last 6–18 months, then the rate jumps.

- Neglecting new purchases: If your new card doesn’t apply payments to transfer balance first, you might pay more interest.

- Low monthly payment: Paying too slowly after the promo ends can mean you lose the benefit.

- Skipping the “what if” comparisons: Always compare transfer vs stay on current card.

- Ignoring budget discipline: A calculator helps with decisions, but you still need to follow through on payments and avoid new debt.

By following these tips and avoiding the mistakes, you’ll get maximum value from your balance transfer planning.

FAQs

Q1: What exactly is a balance transfer?

A: A balance transfer is when you move all or part of the debt from one credit-card account to another (usually to gain a lower interest rate or better terms). Wikipedia

Q2: Does a balance transfer always save me money?

A: Not always. If the fee is high, you pay slowly, or the promo period is short, the savings may be small or even negative. That’s why the calculator is so valuable it helps you evaluate the scenario.

Q3: Can I transfer balances from multiple cards?

A: Yes — many card issuers allow you to transfer multiple balances. In the calculator you can aggregate the totals into a single amount or run separate calculations for each.

Q4: Does the new card’s 0% rate apply to new purchases?

A: Often the 0% rate only applies to the transferred balance, not new purchases. Be sure to check the card’s terms and use the calculator accordingly.

Q5: What happens if I miss the monthly payment after transferring?

A: Missing payments can void the promo rate, trigger penalty APRs, and increase your cost. Always pay on time. Use the calculator’s timeline to set realistic monthly payments.

Q6: Is the calculator suitable for international currencies and banks?

A: Yes — our tool at AllUtilityTools.com supports multiple currencies and input formats if you change the unit settings appropriately.

Conclusion with CTA

Transferring your credit-card balance can be a smart financial move but only if you understand the numbers, the terms and the trade-offs. That’s where a balance transfer calculator becomes your best friend: it helps you compare “stay on my old card” versus “move to the new card” and visualize savings, payoff time and overall cost.

At AllUtilityTools.com, our free online calculator takes the guesswork out of the equation. Plug in your balance, interest rate, promo terms and payment plan and you’ll get immediate clarity on whether a transfer makes sense for you.

Try our Balance Transfer Calculator today, and take control of your debt with confidence. Save money, shorten your payoff timeline, and build a smarter credit-card strategy.